5 Things your 401(k) Advisor Doesn't want you to know

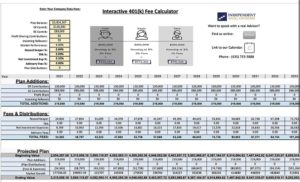

1. What you and your employees are paying in fees

Employers and employees are typically aware of the fund expenses – also known as expense ratios – in their

plan, but are often blind to the other fees that are also tacked on. All in all, employees in small and mid-size company plans are often subjected to paying two to four percent in fees annually on their 401(k) account balances. There’s no need for this to exceed one percent for everything. By staying below the one percent threshold, employees can accumulate tens if not hundreds of thousands of dollars more in savings over a thirty year career.

What are the other fees? Beyond fund expenses, employees in a plan often pay for record keeping, asset management, and commissions passed back to the plan provider or sales person. Some of these fees are fair – as long as they don’t bring the total amount of employee fees to over one percent. Avoid any fund with a commission or any strings attached.

2. Actively managed mutual funds rarely beat the market and aren’t worth paying a premium for

Most 401(k) plans are built with actively managed mutual funds with a goal to beat a

benchmark market index (e.g. the S&P 500). Beating the market sounds like a worthy goal but unfortunately, few fund managers can demonstrate results of doing this consistently over any stretch of time (if ever). Picking stocks is like predicting the weather – very hard to do with any real consistency. Managers not only have to be very good, but they also have to find enough winners to overcome the costs of losers, research, personnel, and added trading costs are common with actively managed funds to outperform an index.

One independent study recently evaluated the performance of 2,100 actively managed funds over a 31 year period and found that only 0.6% of fund managers had stock picking success. How different is that from zero?

Demand index funds in your 401(k) plan. You’ll likely be much better off.

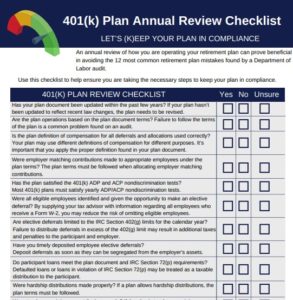

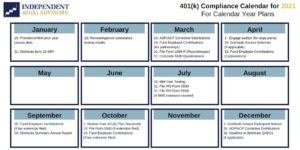

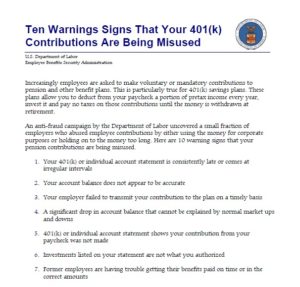

3. They share none of the risk or fiduciary duty on your plan (but you sure do)

When you provide 401(k) benefits, you have the duty to run the plan in the best interest of your employees. Part of those duties includes

monitoring investment options made available and making changes as appropriate, providing guidance materials to members of the plan, etc. While your rep and provider may have given you a list of funds to select from – and even suggested a few – it’s your responsibility. The investment expertise the rep is supposed to provide is actually fully on the employer. Bad funds? Your problem. Employee complaints? Your problem. Employee lawsuit? You get the picture.

So how can you solve this? Choose a provider that will serve as an ERISA 3(38) advisor on your plan. These providers share some important fiduciary duties on your plan. Not only will they take on the burden of managing the fund line-up, but they will also be on the hook for any investment line-up issues that may arise. This extra service shouldn’t cost anything more either.

4. You don’t need a contract to get better service and lower pricing

Many providers of small and mid-size plans offer a contract or require a termination agreement to service your plan. What they don’t tell you

is that it does not commit them to providing you better service or even pricing for that matter. There are many providers that offer great service and better pricing without any kind of contract. Choose one of these to avoid the rigmarole. If you find the provider, investments, or services are not what you need them to be, you don’t want to be locked in to a bad plan.

5. Employee 401(k) benefit meetings add little value

Employees prefer confidential, more personal approaches to discuss their needs. If you have a plan, have you ever

had your advisor hold an employee meeting at rollout and periodically thereafter? How many questions did your employees ask other than how to login? The most common response is zero. People don’t like to discuss their finances or financial knowledge in front of others. Money holds too many social stigmas in our society. It’s not a bad idea to have a kick-off meeting or web conference for educational reasons, just don’t expect any kind of deep discussion

Still, your employees will have questions. With this in mind, ensure your employees understand how to call or meet with an advisor when they need general guidance. Also, make sure they have access to good online education materials. We all have different preferences for learning about finances, so offering a range of options is a great way to tackle this need.

Authored by: Stuart Robertson