About Us

The Firm of Choice

Independent 401(k) Advisors’ deep roots, commitment to innovation, and disciplined oversight of client plans ensure that your company can focus on what it does best and leave the details of qualified plan oversight to us.

Our Formula for Success

Innovation

We constantly scour the marketplace for the best and the latest ideas and services. We constantly update our clients and make sure they have the best of what is available.

Discipline

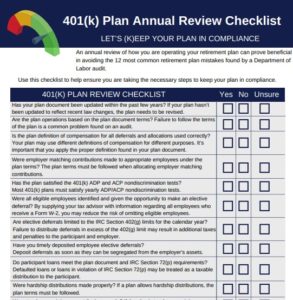

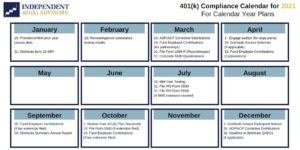

We require every client to adopt a systematic process for governing the minutia forced upon us by legal necessity. Managing a qualified plan requires great attention to detail as well as technical excellence and flawless documentation. You have other things to worry about, so we make these things happen for you.

The Elements of a Successful Plan

Customized options to help executive, key employees, and your rank and file employees

The application of behavioral finance principles to drastically improve the likelihood of plan success.

Access at the plan level to virtually any investment. Since one critical goal of the plan is to have the very best investments, it makes sense to begin with all potential investments available.

Our written process for governance of the plan covers every conceivable aspect of qualified plan management and oversight. You do not need to worry about the details—it is our job to think of everything, decide what needs to be done, and make sure it gets done.

Plenty of national studies exist to tell us that most people are poor investors. Most know this and want help, and part of our job is to make sure they get it. Every participant should have access to a professionally managed option at no additional cost if possible. It should be easy for participants to get it done right, hard for them to choose to do it wrong. Too often plans are set up so that the reverse is true—doing it wrong is the default and it takes great effort to do it right.

Independent 401(k) Advisors serves as a co-fiduciary of your plan. In our role as an investment adviser under ERISA §3(21), we formally accept fiduciary status in writing.

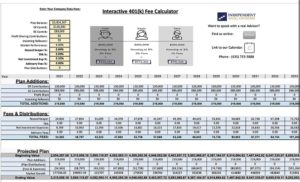

Surprisingly in this era of scandals and investigations, qualified plan costs and revenue-sharing practices are still mostly invisible to clients. In our plans we shed daylight on all costs and vendor compensation practices and strive for complete transparency.

As a fee-only investment adviser, we name a price for our services and draw no additional compensation you do not know about. In keeping with the tradition of objectivity of a fiduciary, we embrace solutions that avoid or eliminate even the potential for conflict of interest.

Process and oversight are important, but they are not the purpose of the plan. The purpose of the plan is to make money for your people while serving your business needs, and in the end it is the results that count. Process and fiduciary duty are simply the environment in which we must accomplish this goal. We focus on the results, and when the results are not clearly what is desired we take action.