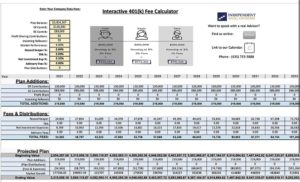

Costs

We Can Help Determine Your Plans Total Cost

The key point to understand is that every plan has a single, bottom-line price tag — the total cost. Yet, only a handful of vendors in the United States quote their prices based on total cost. Pricing is virtually always listed in the form of various schedules, documents, and prospectuses that must be carefully compiled before an accurate picture emerges. We shed light on plan expenses by gathering this data for you, calculating the total cost, and boiling it down to a single number that will allow you to compare your plan’s expenses and make smart choices.

ERISA requires that you as a plan fiduciary act solely in the interests of, and for the exclusive benefit of your plan’s participants and their beneficiaries. As part of that obligation, you need to know the bottom-line price tag of your plan — the total cost.

Despite the ERISA requirements, it is remarkable how few plan sponsors have any idea what their plan actually costs. Sponsors rarely know how much they are paying or to whom. Participants virtually never know what costs they pay. This problem is largely due to the often inadequate disclosure of information by providers regarding the structure and extent of their fees. Without a proper disclosure it is difficult for plan sponsors to make informed choices about vendors, services, and investment options. This is the current state of affairs that the Department of Labor is working to correct, but in the meantime it is extraordinarily difficult to answer this simple question: how much does your plan cost?

Suppose that two employees (in 2 different plans) each contribute the same amount annually into their 401(k) account. They are both invested in exclusively in the same fund which returns an average of 9% annually. However, the first employee’s plan costs 100 basis points more annually than the second employee’s plan. At the end of 35 years, the 2nd employee will have a balance 23% higher than the first employee.

Selecting a service provider or evaluating your current provider should involve a careful analysis of the vendor’s services. Cost is one of the criteria, but not the only criterion. In general, fees can be categorized as follows:

- Asset-based: Expenses are based on the amount of assets in the plan and are generally expressed as percentages or basis point.

- Per-person or per-capita: expenses are based on the number of eligible employees or actual participants in your plan.

- Transaction-based: expenses are based on the execution of a particular plan service or transaction.

- Flat rate: fixed charges that do not vary regardless of the plan size.

Total plan costs are usually calculated using a combination of these methods.

Our Approach To Fees

Are Your Providers Charging Too Much?

The key point to understand is that every plan has a single, bottom-line price tag — the total cost. Fill out the form below and get a free side-by-side comparison of your plan fees