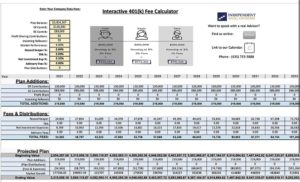

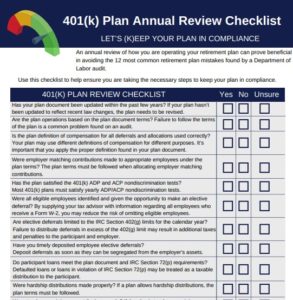

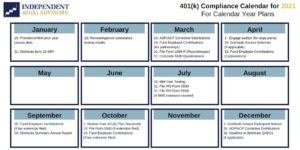

Resources

Free resources and tools to help you better manage your company retirement plan.

2024 Contributions Limits for 401(k)/403(b) plans

The catch-up contribution limit for participants age 50 or older applies from the start of the year to those turning 50 at any time during the year. (If you were born on New Year’s Eve, you can still take it.)